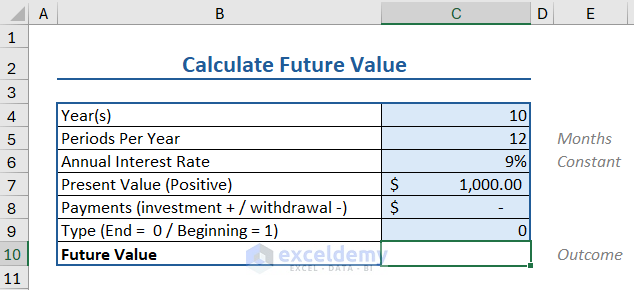

Let’s see an example of how you can apply the FV function to get the future value in Excel. We have the following parameters:

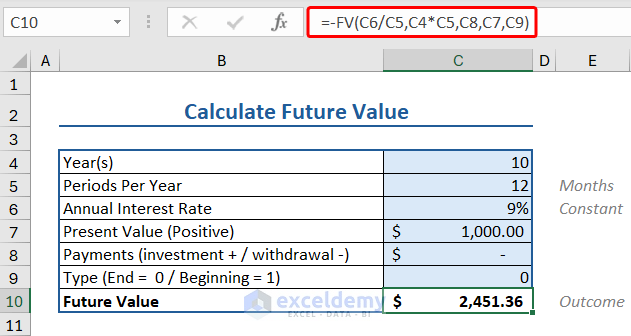

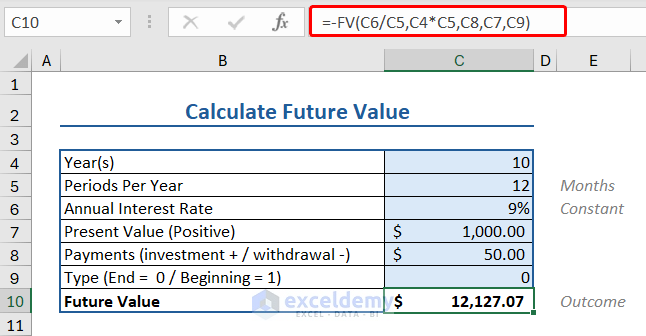

To find the future value, we apply the FV formula as follows:

Let’s say you invest $50 per month. Your account will be valued at $12,127.07

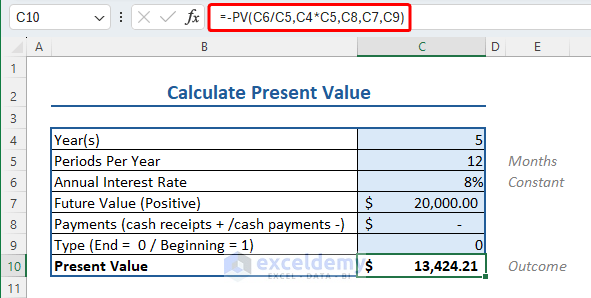

The PV function is an Excel financial function that calculates the present value of an expected cash flow, which can either be a loan or an investment based on a constant interest rate.

The syntax of the PV function is:

PV(rate, nper, pmt, [fv], [type])

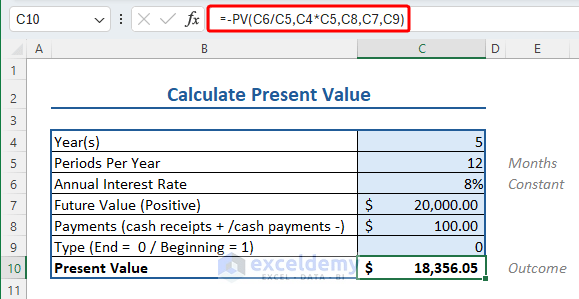

Let’s see an example of how you can apply the PV function to get the present value of a loan in Excel. We’ll use the following:

Insert the following formula to apply the PV formula to calculate the present value:

Let’s say you received a cash receipt of $100 per month. Your account will be valued at $18,356.05

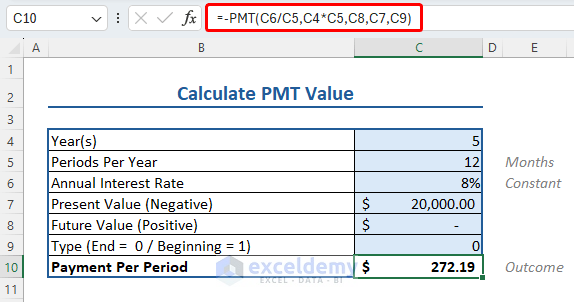

The PMT function calculates the loan payment for a constant interest rate and constant payment.

The syntax of the PMT function is:

PMT(rate, nper, pv, [fv], [type])

Let’s apply the PMT function to get the constant payment for a loan at a constant interest rate in Excel. We’ll use the following:

To apply the PMT formula to calculate the payment per period, insert the following formula:

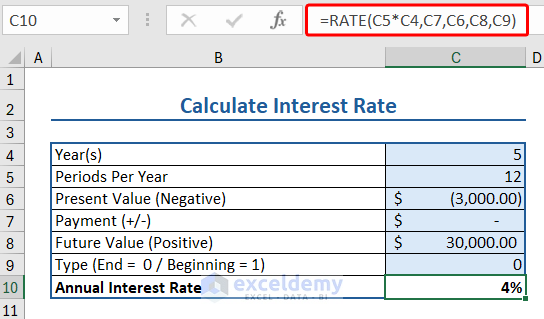

The RATE function calculates the interest rate per period for an investment or loan.

The syntax of the RATE function is:

RATE(nper, pmt, pv, [fv], [type])

Let’s apply the RATE function to get the interest rate for a loan for a fixed period of time in Excel. We’ll use the following:

To apply the RATE formula to calculate the interest rate, insert the following formula:

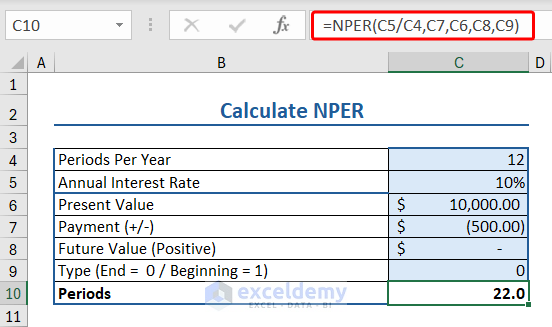

The financial function NPER calculates period numbers for periodic, constant payments for constant interest rates.

The syntax of the RATE function is:

NPER(rate, pmt, pv, [fv], [type])

Let’s apply the NPER function to get the number of periods to pay a loan for a fixed interest rate in Excel. We’ll use the following:

Insert the following formula to apply the NPER function to calculate the interest rate:

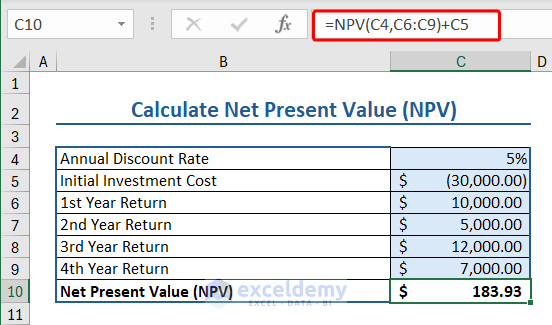

The NPV function calculates the net present value of an investment.

The syntax of the NPV function is:

Let’s use the NPV function to calculate net present value. We’ll use the following:

Insert the following formula to apply the NPV function to calculate the net present value:

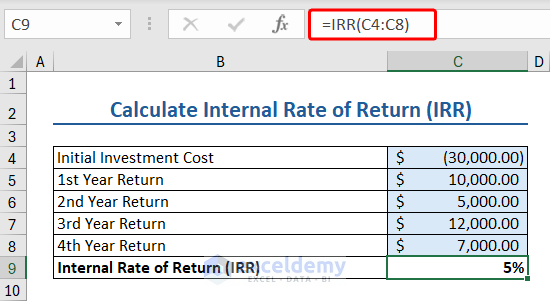

The IRR function calculates the internal rate of return for a series of cash.

The syntax of the IRR function is:

Here we have some data relevant to IRR function:

Insert the following formula to apply the IRR formula to calculate the internal rate of return:

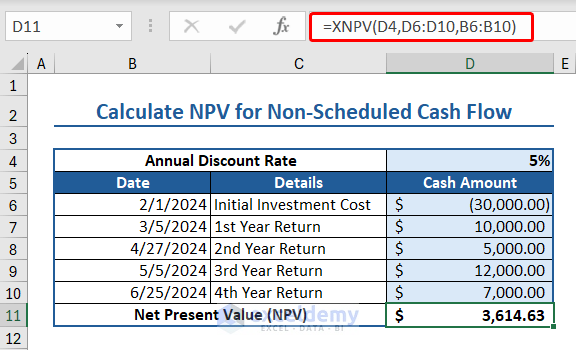

The XNPV function calculates the net present value of net present value of a cash flow series that are not necessarily periodic.

The syntax of the XNPV function is:

XNPV(rate, values, dates)

Here we have some data relevant to XNPV function:

Insert the following formula to apply the XNPV function to calculate the net present value for non-scheduled cash flow:

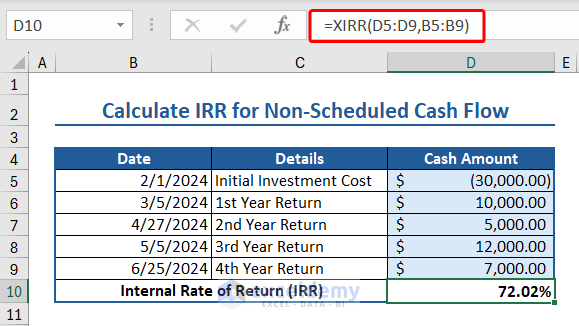

The XIRR function calculates the internal rate of return for a series of cash flows that occur at irregular intervals.

The syntax of the XIRR function is:

XIRR(values, dates, [guess])

Here we have some data relevant to XIRR function:

Insert the following formula to apply XIRR formula to calculate the internal rate of return for non-scheduled cash flow:

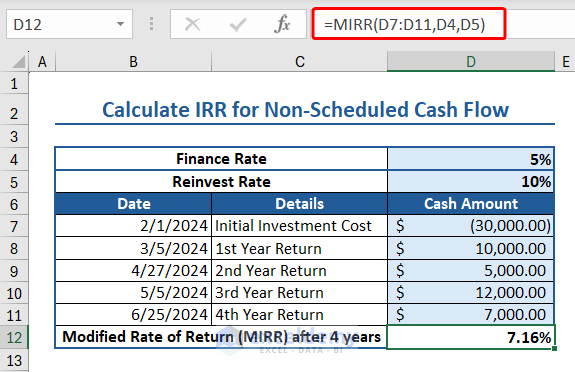

The MIRR function calculates the modified internal rate of return for a series of periodic cash flows. MIRR considers both the cost of the investment and the reinvestment rate.

The syntax of the MIRR function is:

MIRR(values, finance_rate, reinvest_rate)

Here we have some data relevant to MIRR function:

Insert the following formula to apply the MIRR function to calculate the modified internal rate of return after 2 years:

Insert the following formula to apply the MIRR function to calculate the modified internal rate of return after 4 years:

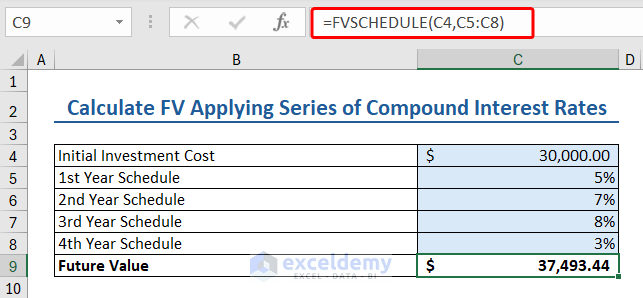

The FVSCHEDULE function in Excel calculates the future value of an investment based on a schedule of interest rates.

The syntax of the FVSCHEDULE function:

Here we have some data relevant to FVSCHEDULE function:

Insert the following formula to apply the FVSCHEDULE function to calculate the future investment value:

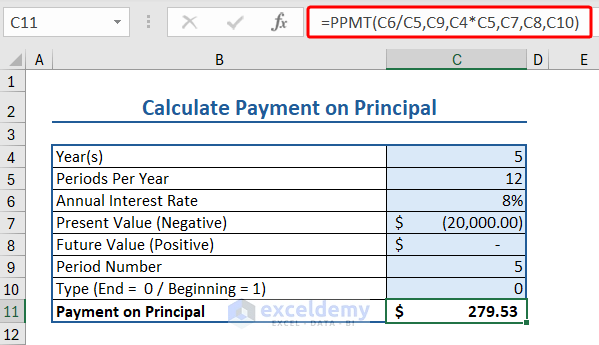

The PPMT function in Excel calculates the payment on principal for a given period.

The syntax of the PPMT function:

PPMT(rate, per, nper, pv, [fv], [type])

Here we have some data relevant to PPMT function:

Insert the following formula to apply the PPMT function to calculate the payment on the principal:

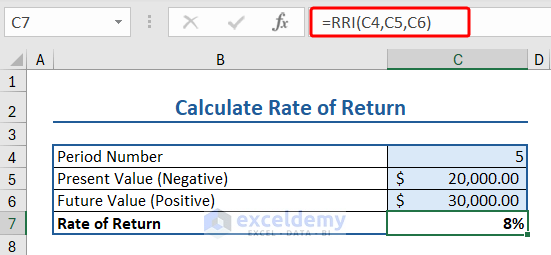

The RRI function in Excel calculates an equivalent rate of interest for the growth of an investment.

The syntax of the RRI function:

Here we have some data relevant to RRI function:

Insert the following formula to apply the RRI function to calculate the rate of return:

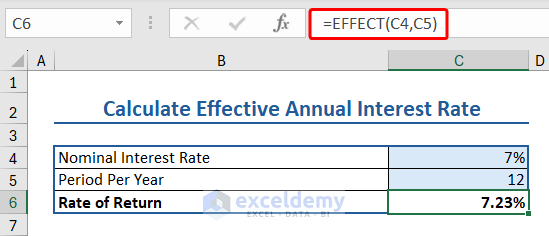

The EFFECT function in Excel calculates the effective annual rate of interest or rate of return.

The syntax of the EFFECT function:

Here we have some data relevant to EFFECT function:

Insert the following formula to apply the EFFECT function to calculate the rate of return:

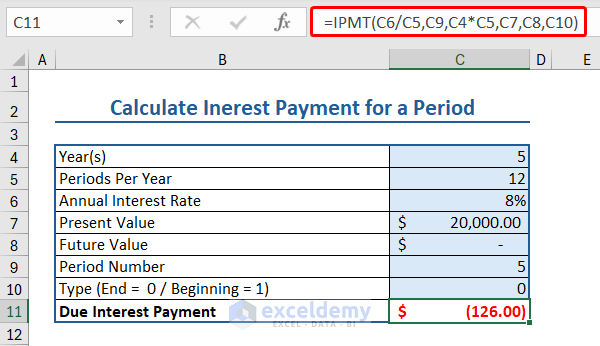

The IPMT function calculates the due interest payment for a periodic, constant payment and interest rate for a given time period.

The syntax of the IPMT function is:

IPMT(rate, per, nper, pv, [fv], [type])

Here we have some data relevant to IPMT function:

Insert the following formula to apply the IPMT function to calculate the interest payment:

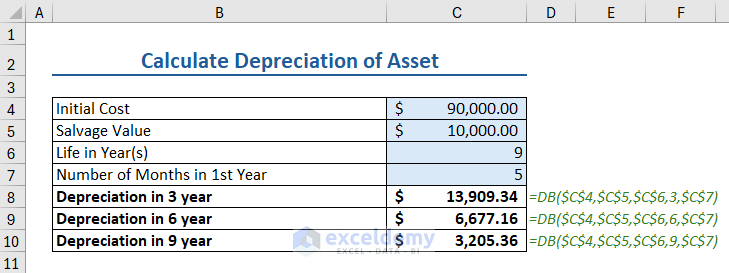

The DB function calculates the depreciation of any asset using a fixed declining way for a definite time period.

The syntax of DB function is:

DB(cost, salvage, life, period, [month])

Let us calculate the depreciation value of an asset using DB function. We’ll use the following:

We will calculate the depreciation value of the asset after 3, 6, and 9 years.

To apply the DB function in Excel, insert the following formula in a cell:

We calculated the depreciation value after 6 and 9 years, as shown in the image below.

The STOCKHISTORY function loads the historical data from a certain period of time regarding a financial instrument (stock) as an array. When this spill formula is applied, Excel dynamically returns the data range in the required amount of cells.

Note:This function is available only for Microsoft 365 Personal, Family, Business Standard, and Business Premium versions

The syntax of STOCKHISTORY function is:

STOCKHISTORY(stock, start_date, [end_date], [interval], [headers], [property0], [property1], [property2], [property3], [property4], [property5])

Let’s see how this STOCKHISTORY function works in Excel. We’ll use the following information:

Insert the following formula in a cell that has enough blank cells below to place the data fetched using the STOCKHISTORY function: